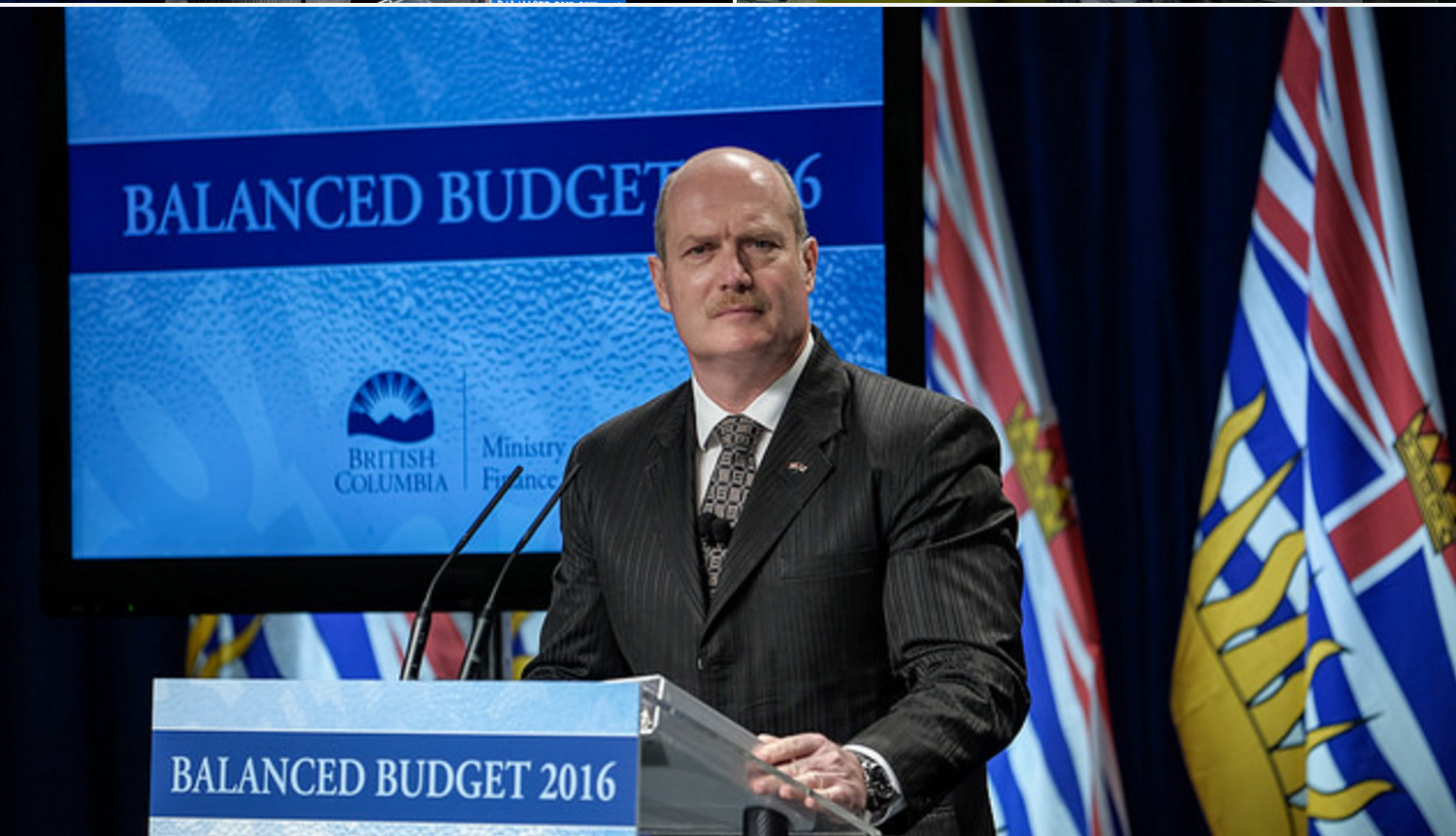

Finance Minister Mike De Jong’s budget outlined $47.5 billion in spending for the 2016/17 fiscal year, starting April 1, with a projected $264 million surplus. It’s the fourth consecutive surplus budget for the Liberal government

A truss is lowered into place at a new home construction site on Burke Mountain in Coquitlam.

Photograph by: Jason Payne Jason Payne , PNG

VICTORIA — Premier Christy Clark responded to intense public pressure to fix Metro Vancouver’s housing affordability crisis Tuesday with a budget that offered a tax break on new homes and the promise to start collecting data on foreign buyers.

But real estate, business and academic experts say the modest changes will do little to spur new construction, slow price hikes or help most buyers get into the market.

The changes will see buyers save up to $13,000 from B.C.’s property transfer tax if they purchase a newly built home, condo or townhouse valued under $750,000, as long as they are Canadian residents who live in the home for at least a year. The tax break starts today.

It’s designed to boost the supply of new home construction and give people a helping hand to enter the market, said Finance Minister Mike de Jong. But it won’t cool the market enough for those who say they can’t afford to live in the Lower Mainland.

“If by cool you mean actually reduce the value of people’s major asset, their home, clearly we were not interested in taking that step,” said de Jong.

The tax break will be offset by a one-per-cent increase to the property transfer tax, to three per cent, on luxury homes that sell for more than $2 million.

Critics say the budget amounts to half-measures from a government that’s stuck between not wanting to intervene directly in the housing market and needing to look responsive to public frustration.

“It’s an attempt to try to be seen to be doing something; but lets face it, it’s not going to change affordability in Metro Vancouver very much at all,” said Jim Brander, a professor at the University of B.C.’s Sauder School of Business.

“It is possible to do things — there are big steps that could be taken,” Brander said, pointing as an example to moves in other countries to disallow foreign ownership and perhaps cause losses on people’s real estate investments.

“That would have a big impact, but that’s a huge step that Christy Clark has said, of course, she doesn’t want to take.”

Instead, Brander said, the government is giving a small measure of tax relief to some buyers.

“Relative to the cost of housing, what’s that going to do? Not much.”

Opposition NDP leader John Horgan said the government has made only “cosmetic changes around the edges” on housing and ignored a recent suggestion from university professors to create a B.C. Housing Affordability Fund built upon a 1.5-per-cent real estate surcharge on foreign owners.

There will be years of lag before new homes are built, even though the tax break is an overall good idea, said Cameron Muir, chief economist for the B.C. Real Estate Association.

“It will probably be effective to some extent but I don’t think you’re going to see a dramatic change,” added Ken Peacock, B.C. Business Council’s chief economist. It would be “very difficult” for government to change the housing market prices, he said.

The affordability measures were “helpful but modest,” said Jon Stovell, president at Reliance Properties and the incoming chair of the board at the Urban Development Institute.

“They’re certainly going in the right direction,” Stovell said, noting that about 80 per cent of non-single-family housing sold in the region is under the $750,000 price.

But Stovell said the new luxury tax rate for homes over $2 million was “a little bit disappointing” because the charge could end up being paid by developers purchasing land for new condos or townhomes and then passing on those costs to buyers of individual units.

Even as government sought to cool the housing market, it is enjoying a financial windfall from the property transfer tax it charges on sales. Revenue from that tax has jumped more than 40 per cent above last year’s expectations and is on track to bring in $1.5 billion in the current fiscal year — surpassing the revenue earned by the carbon tax.

Though some analysts continue to blame wealthy foreign buyers as one of the main drivers of rising home prices, the finance minister said he’s yet to see concrete data on how foreign ownership is impacting B.C.’s housing market. De Jong said he’d implement new rules that anyone buying real estate in the province will need to disclose their citizenship or country of residence, but wouldn’t speculate on whether that lays the groundwork for a future tax on foreign ownership or vacant homes.

“Before we were prepared to take a step of that significance we felt obligated to ensure we have better information,” he said.

De Jong said the province would also step up the sharing of information with the federal government, which is also trying to get a handle on foreign real estate investment and the avoidance of taxes.

The housing file was just one example of how Tuesday’s budget was mainly an attempt by the premier to do “political damage control” on high-profile files that she wants to clear off her plate in the run-up to next year’s election, said University of Victoria professor Michael Prince.

That includes $217 million over three years in additional funding for the Ministry of Children and Family Development, which has been rocked by several deaths and suicides involving children in care.

“This is an investment in trying to address some of those crises, and I suspect some of them will continue to flare up,” he said.

Next year’s budget, which will land three months before the May provincial election, will likely contain more sweeping and substantive changes to issues like housing affordability and rising Medical Services Plan premiums, said Prince.

Government exempted children from MSP rates in Tuesday’s budget, but once again raised rates for adults, adding hundreds of dollars a year to the costs of many families. A promised overhaul to what the premier has called an “antiquated” and unfair MSP system failed to materialize.

Her government did increase the disability income assistance rate for the first time in nine years, boosting the monthly rate by $77 to $983, effective Sept. 1. But those already receiving bus passes or transit assistance will get a lesser increase. The province’s overall welfare rate did not change, continuing a trend from the premier to target financial relief for certain groups without increasing overall assistance rates for the larger population.

The $47.5-billion 2016/17 budget estimated a projected $264-million surplus in the fiscal year starting April 1.

Education funding remained mostly frozen, while health care spending is set to increase by almost three per cent to $19.6 billion — or 41 per cent of total government spending.