by Kathleen A. Lahey

After running up $164 billion in total annual deficits between 2008/9 and 2014/15, the Harper government says it will have a $3.7 billion surplus in 2015/16 – and plans to spend nearly $3 billion of it on parental income splitting. Although government references to this plan have been muted, with vague references to ‘new tax cuts,’ the promise of parental income splitting has been on the agenda for years. And there is good reason to keep the details vague. It is beyond dispute that parental income splitting will give lavish tax benefits to the richest families while giving shockingly small benefits to those who actually need them the most.

The government’s declared reason for making such expensive tax cuts for Canada is that it will be ‘fairer’ to parents. Parental income splitting will let couples with children under age 18 shift up to $50,000 in income from one spouse or partner to the other to get the lowest possible tax rate on that $50,000.

In fact, this new tax provision would be extremely unfair. An Ontario couple with a single income of $190,000 or higher would receive a total federal plus provincial tax cut of $11,592 in 2014 if Ontario goes along with parental income splitting. $6,600 of that cut would be paid by the federal government, the balance by the provincial government.

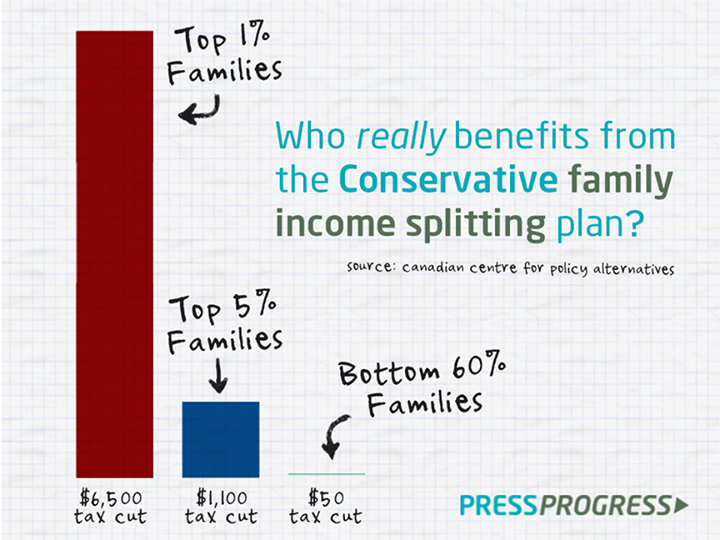

The chart below shows how much couples at different household income levels are estimated to get from federal parental income splitting in 2014. Each decile contains 10% of all families, arranged by family incomes. Couples in the first decile have average family incomes of $30,600 or less. These couples will get an estimated $9 per year from these new tax cuts to help them give their children a good start in life.

The tenth decile contains the 10% of families with the very highest family incomes. Couples with children who fall into this decile will receive federal tax cuts worth an average of $1,914 per year, up to the maximum of $6,600 per year for those living on single incomes of $187,000 or more.

The key to getting maximum tax benefits from parental income splitting benefits will be for couples to aim for the ‘primary breadwinner’ model of family life, where one spouse/partner earns all the family income, and the other has as little income as possible.

These tax cuts are ‘upside down’

These tax benefits are ‘upside down’ because they give the biggest benefits to the people who need them the least. Canada’s progressive income tax system sets a higher tax rate for those with higher incomes. When large ‘across the board’ tax cuts are made to that progressive system, those tax cuts will always give the biggest tax benefits to those with the biggest incomes.

As shown in the table above, upside-down tax cuts like income splitting are unfair because they give the smallest benefits – or no benefits at all – to those who need them the most.

What is parental income splitting really for?

If the Harper government has decided to give new special tax benefits to parents with children, presumably it is because the government wants to do everything it can to help all parents give their children the very best start in life they can.

But, if parental income splitting is to help make sure all children get the best possible start in life, why should parents who need the most financial assistance raising their children get small federal benefits like $9 or $74 or $104 per year – while those who need it the least will get an average of $1,008 or $1,091 or $1,914 per year, and as much as $6,600 per year? Why should parents who can already do virtually anything they want to help their children off to a good start need such generous help from the federal government?

How is this tax cut fair? With children all across the country going to school hungry every day, how do such extremely unequal benefits help give all children in Canada the best possible start in life?

Canadian families need ‘right side up’ benefits –

If the government wants to spend $2.7 billion on families with children, and wants to do it fairly, there are many better alternatives.

For example, if that $2.7 billion were added to the Canada Child Tax Benefit (CCTB), these new benefits would go to families at all levels of income, and even the richest families would get some benefit. The CCTB is calculated according to family incomes and is most generous to those parents who need the most help giving their children a good start in life. And because the CCTB provides benefits even to those fairly high on the income scale, high income parents would also receive benefits as well.

http://www.taxfairness.ca/en/news/income-splitting-huge-tax-cuts-rich-families